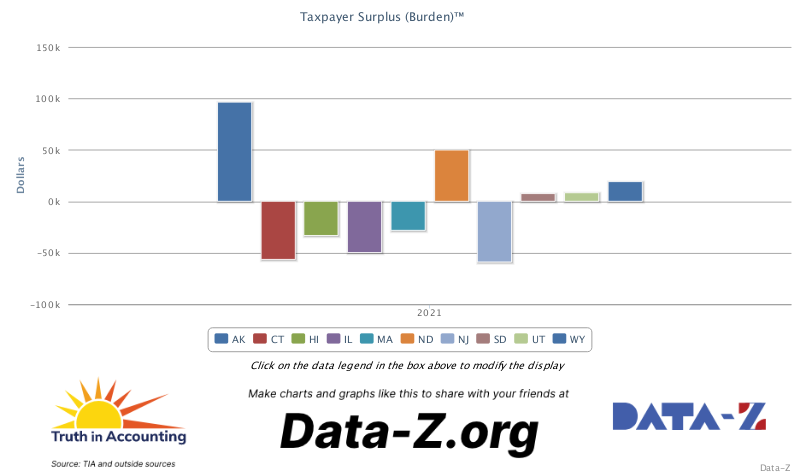

50-State Average of Unfunded Pension Benefits

Our 2025 Financial State of the States report paints a stark picture of fiscal irresponsibility across the U.S., with unfunded pension liabilities emerging as one of the most pressing threats to long-term state solvency.

These liabilities represent promised retirement benefits to public employees—such as teachers, firefighters, and state workers—that governments have committed to but failed to adequately fund. By shortchanging pension contributions today, states are effectively borrowing from the future, shifting massive costs onto tomorrow's taxpayers. This practice not only undermines balanced budgets but also erodes public trust in government accounting. Drawing from the most recent audited financial reports (primarily fiscal year 2024, with some states using 2023 data due to delays), we reveal a collective national shortfall that underscores the urgency for reform. READ MORE