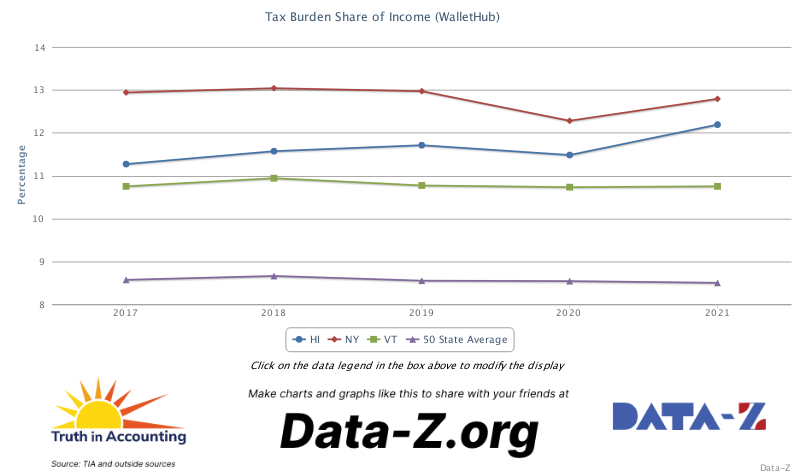

New York, Hawaii, and Vermont have largest tax burdens

On March 31, WalletHub released their annual Tax Burden by State report for 2021 in which they evaluate and rank the “tax burden” for the citizens of each of the 50 states. This report differs from Truth in Accounting’s evaluation of “Taxpayer Burden” because WalletHub’s tax burden measures the proportion of total personal income residents pay in state and local taxes while Taxpayer Burden from Truth in Accounting the amount of money needed by states to pay bills divided by the number of state taxpayers to come up with the Taxpayer Burden.

The findings from this report show that New York state has the highest tax burden at 12.79% followed by Hawaii (12.19%) and Vermont (10.75%). This representation of how much total personal income residents pay in state and local taxes helps apprehensive taxpayers understand how taxes this year will affect their finances in this time of crisis in a simple and comprehensible way.