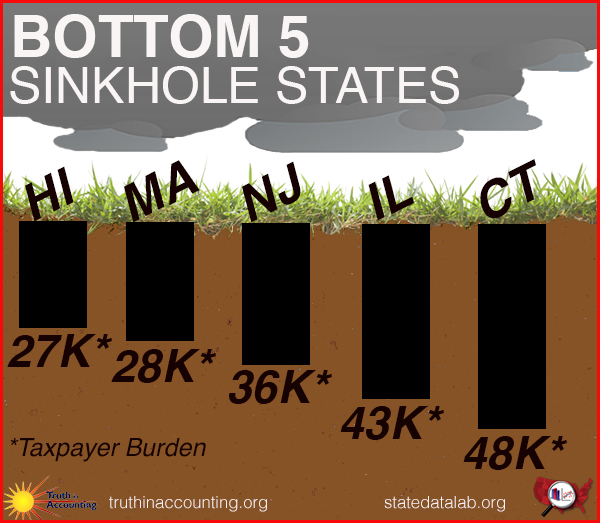

2013 Worst Sinkhole States

August 8, 2014: Massachusetts joins the group of 5 worst “Sinkhole States” in the fifth annual Truth in Accounting (TIA) study of state finances. These five states have the highest debt per taxpayer after available assets are tapped. TIA’s unique, thorough asset and liability analysis also shows four of these states increased their debt in 2013.

|

State |

Taxpayer’s Burden 2013 |

Taxpayer’s Burden 2012 |

Increase (Decrease) In Taxpayer Burden |

|

Connecticut |

$48,100 |

$46,000 |

$2,100 |

|

Illinois |

$43,400 |

$42,200 |

$1,200 |

|

New Jersey |

$36,000 |

$34,200 |

$1,800 |

|

Massachusetts |

$28,000 |

$25,500 |

$2,500 |

|

Hawaii |

$27,000 |

$41,300 |

($14,300) |

'Taxpayer Burden' is each taxpayer’s share of their state’s debt after setting aside capital-related debt and assets. Remaining debt is primarily unpaid pension and retirement health promises.

· Retirement costs are employee compensation, just like current payroll

· States should make pension and retirement health contributions yearly, along with payroll

· Many states make only partial retirement payments, but they hide the growing debt from public view. See Hidden Retirement Debt: CT, HI, IL, MA, NJ Check your state by selecting “Edit Chart Criteria,” select your state on the next page, and scroll down to “Generate Chart”

Hawaii’s debt decreased with an accounting trick. “Pre-funding” only $100 million of retirement health debt allowed the state to assume a higher rate of return for that fund, decreasing that debt by over $4 billion. See http://www.truthinaccounting.org/news/detail/hawaii-drowning-in-debt

See more about your state’s financial condition by selecting it on the state map at http://www.statedatalab.org/