New York

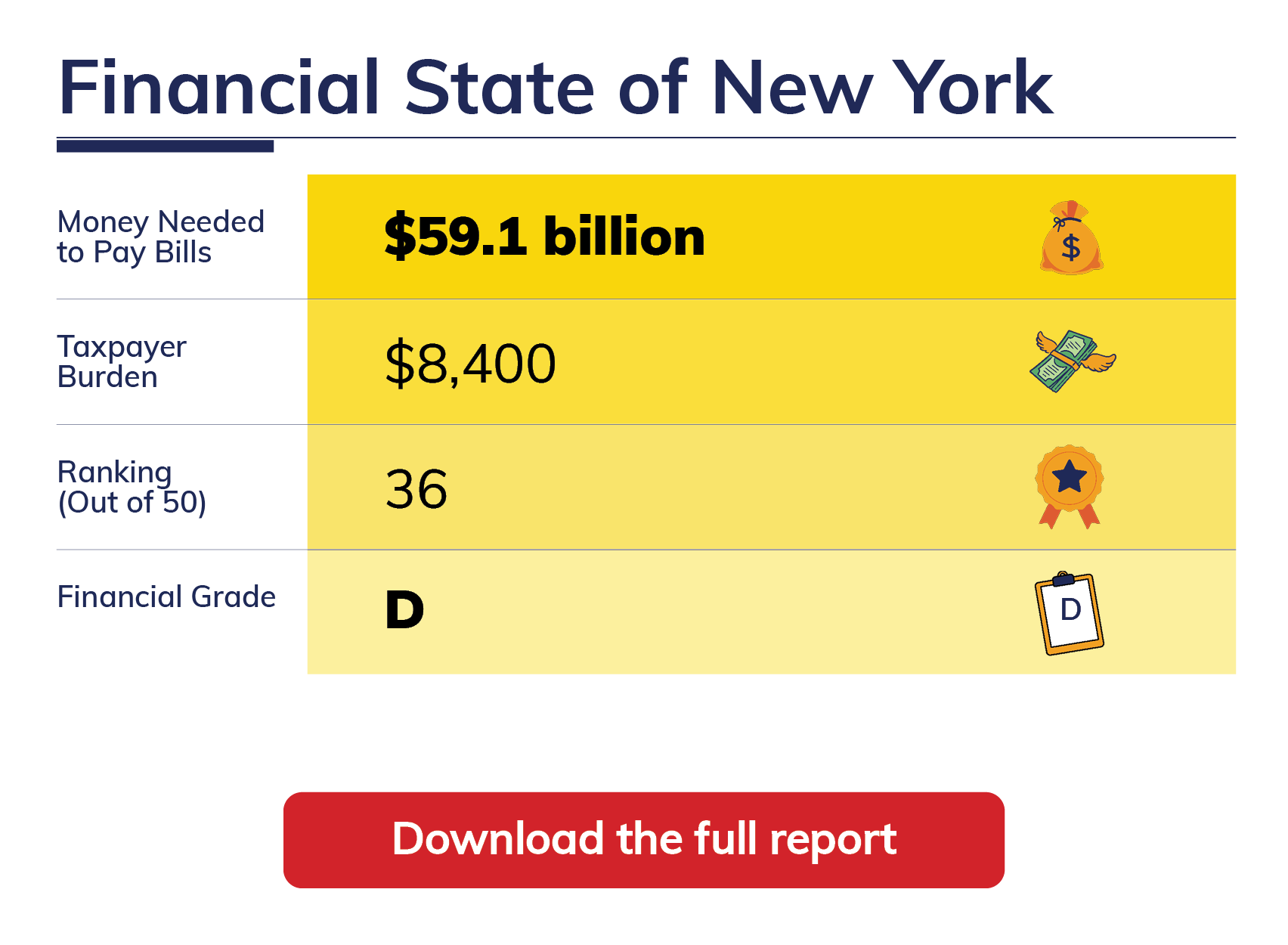

| New York owes more than it owns. |

| New York has a -$8,400 Taxpayer Burden.™ |

| New York is a Sinkhole State without enough assets to cover its debt. |

| Elected officials have created a Taxpayer Burden™, which is each taxpayer's share of state bills after its available assets have been tapped. |

| TIA's Taxpayer Burden™ measurement incorporates both assets and liabilities, not just pension debt. |

| New York only has $230 billion of assets available to pay bills totaling $289.1 billion. |

| Because New York doesn't have enough money to pay its bills, it has a -$59.1 billion financial hole. To fill it, each New York taxpayer would have to send -$8,400 to the state. |

| New York's reported net position is overstated by $1.4 billion, largely because the state delays recognizing losses incurred when the net pension liability increases. |

| The state's financial report was released 154 days after its fiscal year end, which is considered timely according to the 180 day standard. |

Prior Years' TIA Reports

2023 Financial State of New York

2022 Financial State of New York

2021 Financial State of New York

2020 Financial State of New York

2019 Financial State of New York

2018 Financial State of New York

2017 Financial State of New York

2016 Financial State of New York

2015 Financial State of New York

2014 Financial State of New York

2013 Financial State of New York

2012 Financial State of New York

2011 Financial State of New York

City and Municipal Reports

Financial State of New York City

Other Resources

New York Annual Comprehensive Financial Reports

Publishing Entity: Office of New York State Comptroller