Nevada

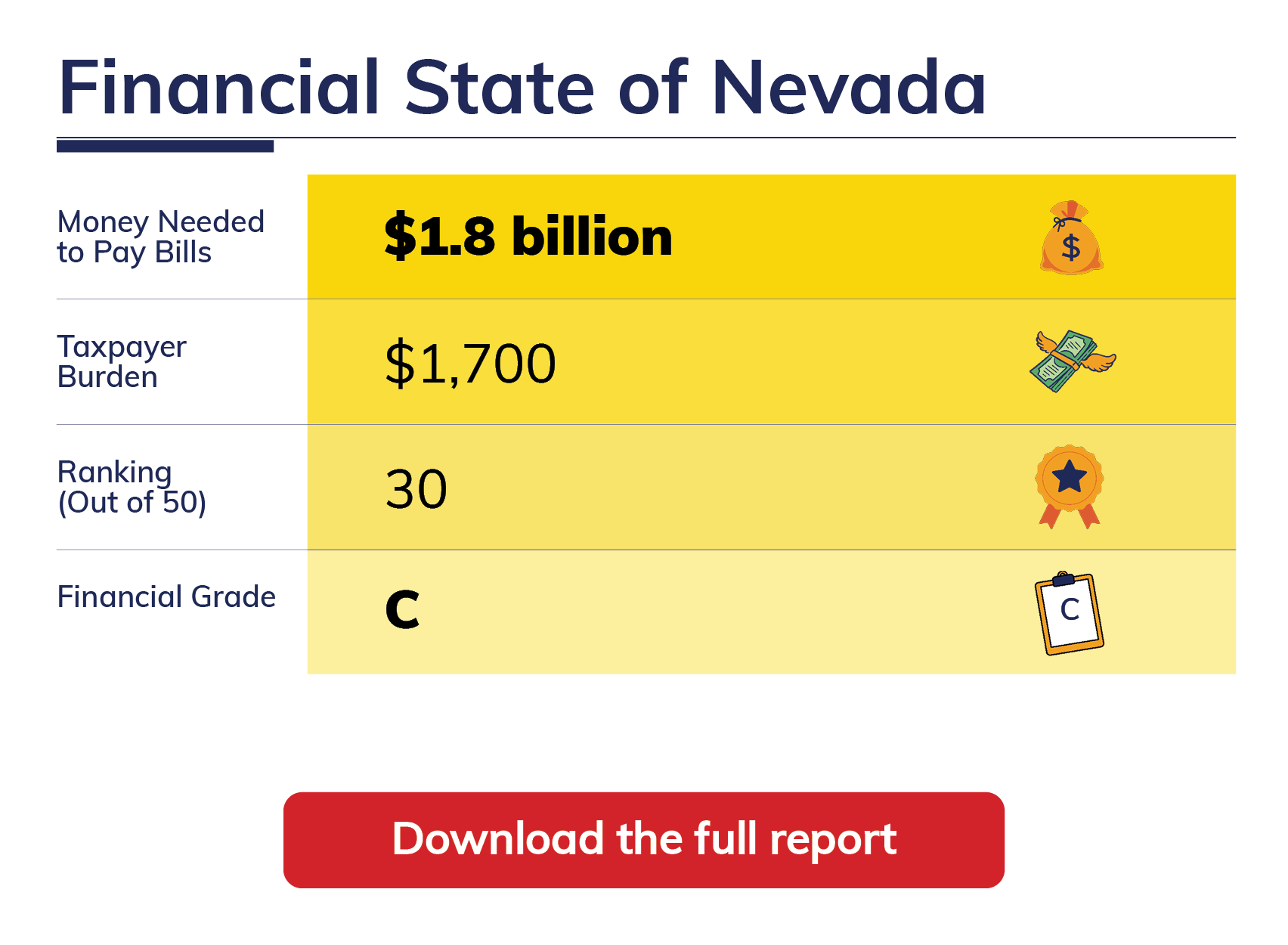

| Nevada owes more than it owns. |

| Nevada has a -$1,700 Taxpayer Burden.™ |

| Nevada is a Sinkhole State without enough assets to cover its debt. |

| Elected officials have created a Taxpayer Burden™, which is each taxpayer's share of state bills after its available assets have been tapped. |

| TIA's Taxpayer Burden™ measurement incorporates both assets and liabilities, not just pension debt. |

| Nevada only has $11.3 billion of assets available to pay bills totaling $13.1 billion. |

| Because Nevada doesn't have enough money to pay its bills, it has a -$1.8 billion financial hole. To fill it, each Nevada taxpayer would have to send -$1,700 to the state. |

| Nevada's reported net position is understated by $371.4 million, largely because the state delays recognizing gains resulting from decreases in retirement liabilities. |

| As of Aug 25, 2025, more than two years after the end of its June 30, 2023 fiscal year, the state had still not released its financial report for that year. This unacceptable delay is outrageous and severely undermines trust in the state’s transparency and accountability. |

Prior Years' TIA Reports

2023 Financial State of Nevada

2022 Financial State of Nevada

2021 Financial State of Nevada

2020 Financial State of Nevada

2019 Financial State of Nevada

2018 Financial State of Nevada

2017 Financial State of Nevada

2016 Financial State of Nevada

2015 Financial State of Nevada

2014 Financial State of Nevada

2013 Financial State of Nevada

2012 Financial State of Nevada

2011 Financial State of Nevada

City and Municipal Reports

Other Resources

Nevada Annual Comprehensive Financial Reports

Publishing Entity: Nevada State Controller's Office