Ohio

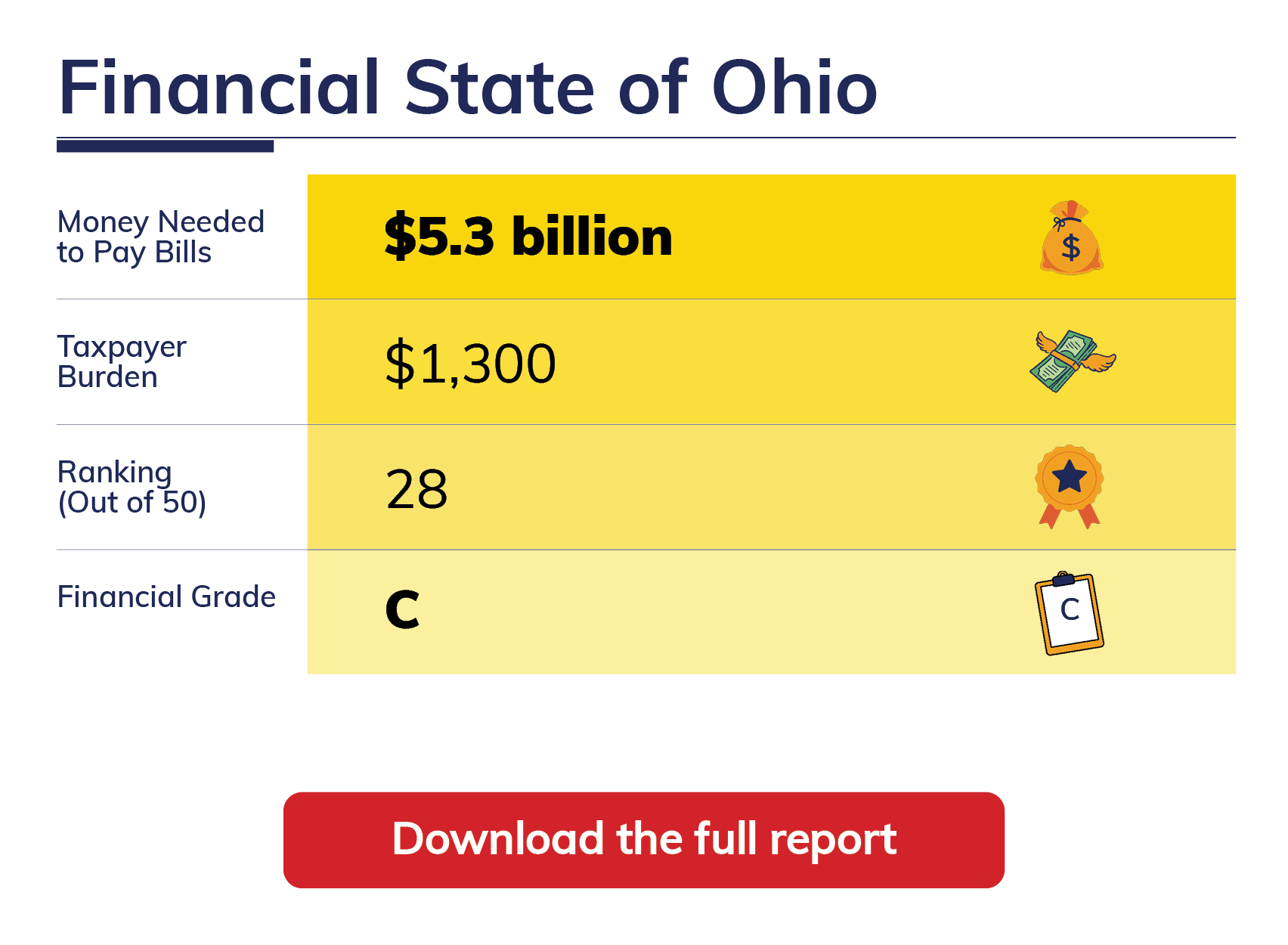

| Ohio owes more than it owns. |

| Ohio has a -$1,300 Taxpayer Burden.™ |

| Ohio is a Sinkhole State without enough assets to cover its debt. |

| Elected officials have created a Taxpayer Burden™, which is each taxpayer's share of state bills after its available assets have been tapped. |

| TIA's Taxpayer Burden™ measurement incorporates both assets and liabilities, not just pension debt. |

| Ohio only has $71.4 billion of assets available to pay bills totaling $76.7 billion. |

| Because Ohio doesn't have enough money to pay its bills, it has a -$5.3 billion financial hole. To fill it, each Ohio taxpayer would have to send -$1,300 to the state. |

| Ohio's reported net position is overstated by $5.6 billion, largely because the state delays recognizing losses incurred when the net pension liability increases. |

| The state's financial report was released 171 days after its fiscal year end, which is considered timely according to the 180 day standard. |

Prior Years' TIA Reports

City and Municipal Reports

Other Resources

Ohio Annual Comprehensive Financial Reports

Publishing Entity: Office of Budget and Management - State Accounting