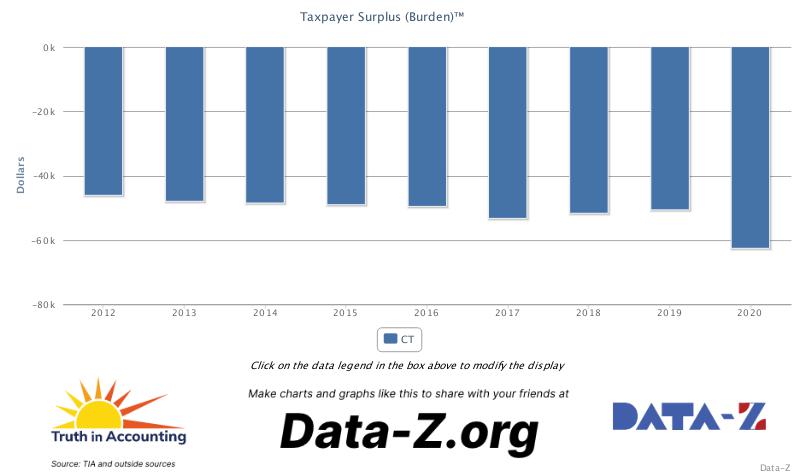

Connecticut’s Taxpayer Burden grows to more than $62,000

This chart displays Connecticut’s Taxpayer Burden™ over the past eight years. A Taxpayer Burden is the approximate dollar amount that would be required of each taxpayer in order to pay off all of a government's liabilities today. It is calculated by dividing the "money needed to pay bills" by the estimated number of taxpayers in the state or city.

Between 2019-2020 Connecticut’s Taxpayer Burden increased by $11,800 to $62,500 in 2020. Connecticut’s Taxpayer Burden increased because the state has not been properly funding retirement obligations, such as pensions, for years.

Like a majority of states, Connecticut did not set themselves up to endure the pandemic. Without properly funding its pension and retiree health care promises and making better financial decisions, Connecticut’s Taxpayer Burden will continue to increase.