Have Falling Interest Rates Helped the States?

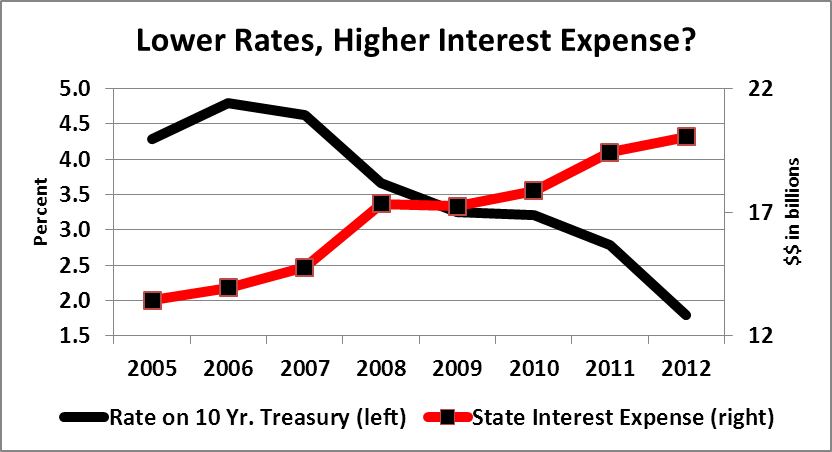

Interest rates have been falling significantly since 2007. Falling interest rates can help organizations in debt, if they can refinance at lower interest rates. But looking across the 50 states, interest expense reported by state governments has been marching higher anyway.

From fiscal 2005 to 2012, total interest expense reported by state governments more than doubled, even as the 10-year Treasury rate fell by two-thirds. (Note: we estimated New Mexico interest expense for its June 2012 fiscal year. As of July 2013, New Mexico still hasn’t reported its 2012 results.)

But the 50 states are far from equal. After ranking the states on the ratio of interest expense to population, it appears that the “rising interest expense amidst falling interest rates” story is concentrated in states with higher interest expense per capita. Those states also tend to carry higher Taxpayer Burdens, as estimated by Truth in Accounting.

Where does your state stack up in this picture? You can do these calculations easily using State Data Lab. For example, the interest expense data we have gathered from the annual state financial reports appears in the “State Financial Data” section.