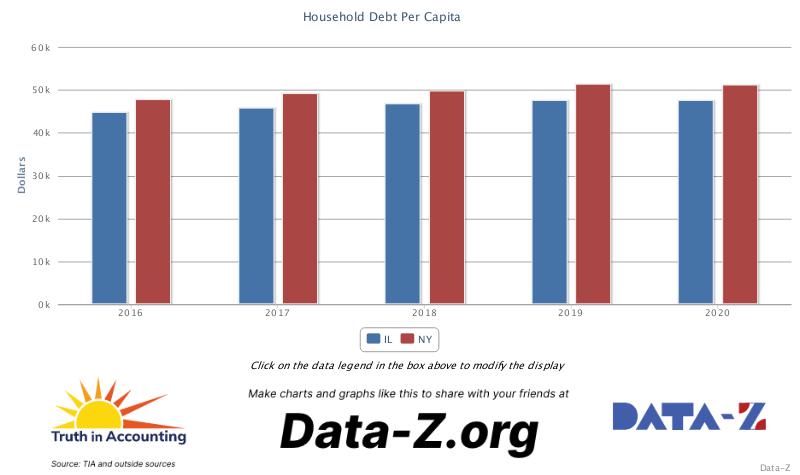

Household debt increasing in Illinois and New York

This chart compares New York’s and Illinois’ household debt per capita between 2016 and 2020. From 2018 to 2019, both states’ household debt per capita increased by roughly $2,000. Although both New York’s and Illinois’ household debt per capita remained constant from 2019 to 2020, it can be assumed that in 2021 both Illinois’ and New York’s household debt per capita might increase because of the global pandemic. Specifically, one article states there were “8.5 million fewer jobs in February 2021 than in February 2020.”. This rate of unemployment suggests that those who lost their jobs due to the pandemic might have needed to do everything necessary, such as borrow money, to survive this global crisis.

In summary, this chart shows the slight increases in household debt per capita for New York’s and Illinois’ state residents over a five-year time period. Similar to those in other populated states, residents affected by COVID-19 unemployment rates have little-to-no income which affects their ability to float financially above personal debt lines, while competition remains high throughout the workforce in 2021.