States Walking the Talk -- for a Balanced Budget Amendment

The Balanced Budget Amendment Task Force (www.BBA4USA.org) supports efforts to develop an Article 5 convention of the states. This convention would propose an amendment to the United States Constitution implementing a balanced budget requirement for the federal government. The Task Force believes there are 17 states with active applications in this effort, and has identified 17 other states deemed ‘likely’ to develop such applications.

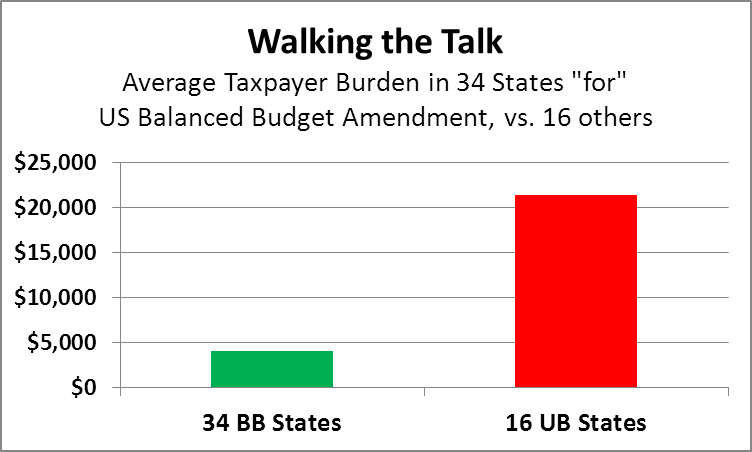

As a general rule, these 34 states take care of business back at home. For example, the latest average Taxpayer Burden estimated by Truth in Accounting for those 34 states came to roughly $4,000, less than one-fifth the $21,400 burden estimated for the other 16 states, on average. (You can see a description of Truth in Accounting’s “Taxpayer Burden” metric here.)

State Data Lab also calculates and reports a metric called “Net Revenue.” This measure subtracts state government net expenses (expenses less fees and grants) from general revenue, and provides one check on whether states are truly ‘balancing their budgets.’ From 2005 to 2012, the 34 states with active or ‘likely’ Article 5 applications had a balanced budget frequency rate 50% better than that of the other 16 states.

The chart below puts the 50 states in 8 buckets, based on the number of times they posted positive net revenue (a ‘balanced budget’) from 2005 to 2012. From left to right, bucket number 1 has one state (Illinois) that only ‘balanced its budget’ once from 2005 to 2012. There are a growing number of states in the other buckets, which range up to the four states (Montana, Maine, North Dakota, and Utah) that posted positive net revenue in all of the eight years ended in 2012. In turn, the left axis (or y-axis) represents the share of the states in each of those buckets with active or ‘likely’ Article 5 convention applications. The chart shows that states that balance their own budgets more frequently are also more likely to support an amendment to the US Constitution requiring a balanced federal government budget.