Louisville, KY

,

|

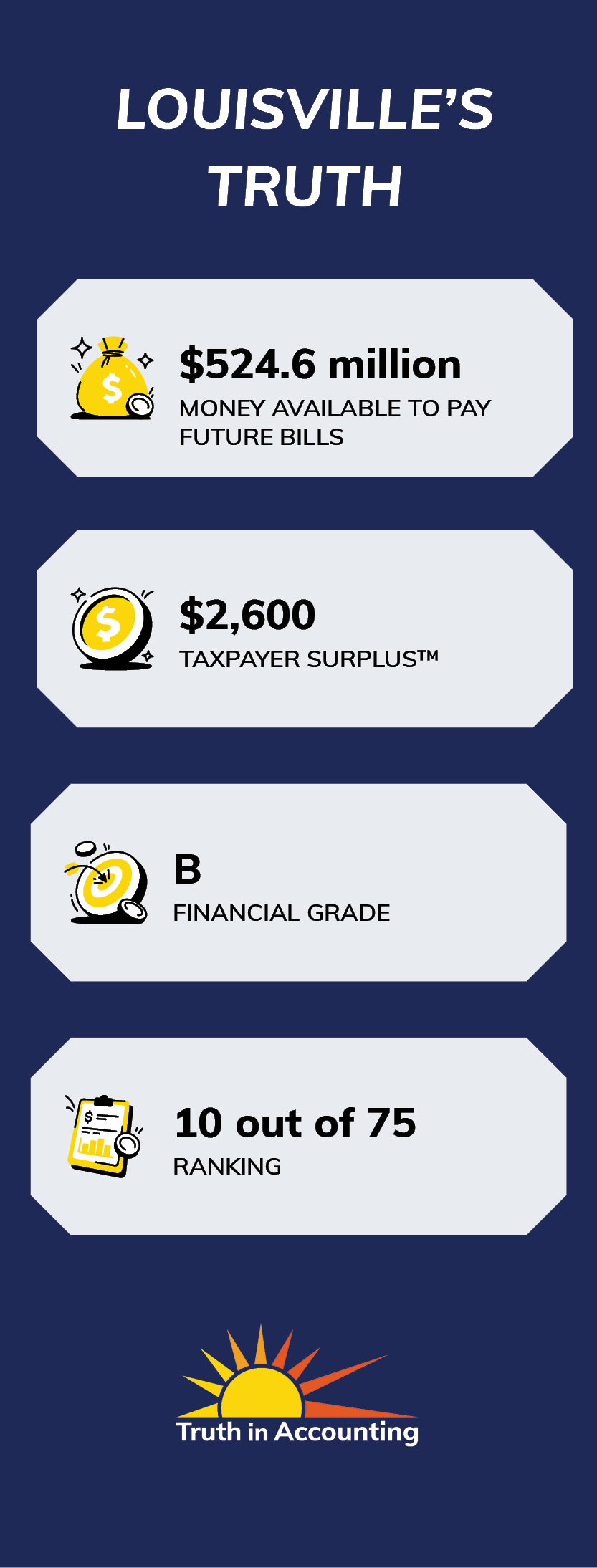

TIA Data 2023 Financial State of Louisville (Released 02/27/2024) Use Create Your Own City Chart to see additional financial, demographic and economic data for this and other cities

Prior Years' TIA Data2022 Financial State of Louisville 2021 Financial State of Louisville 2020 Financial State of Louisville 2019 Financial State of Louisville 2018 Financial State of Louisville 2017 Financial State of Louisville 2016 Financial State of Louisville 2015 Financial State of Louisville

Other ResourcesLouisville Annual Comprehensive Financial Reports Publishing Entity: Office of Management & Budget |