U.S. Government

,

|

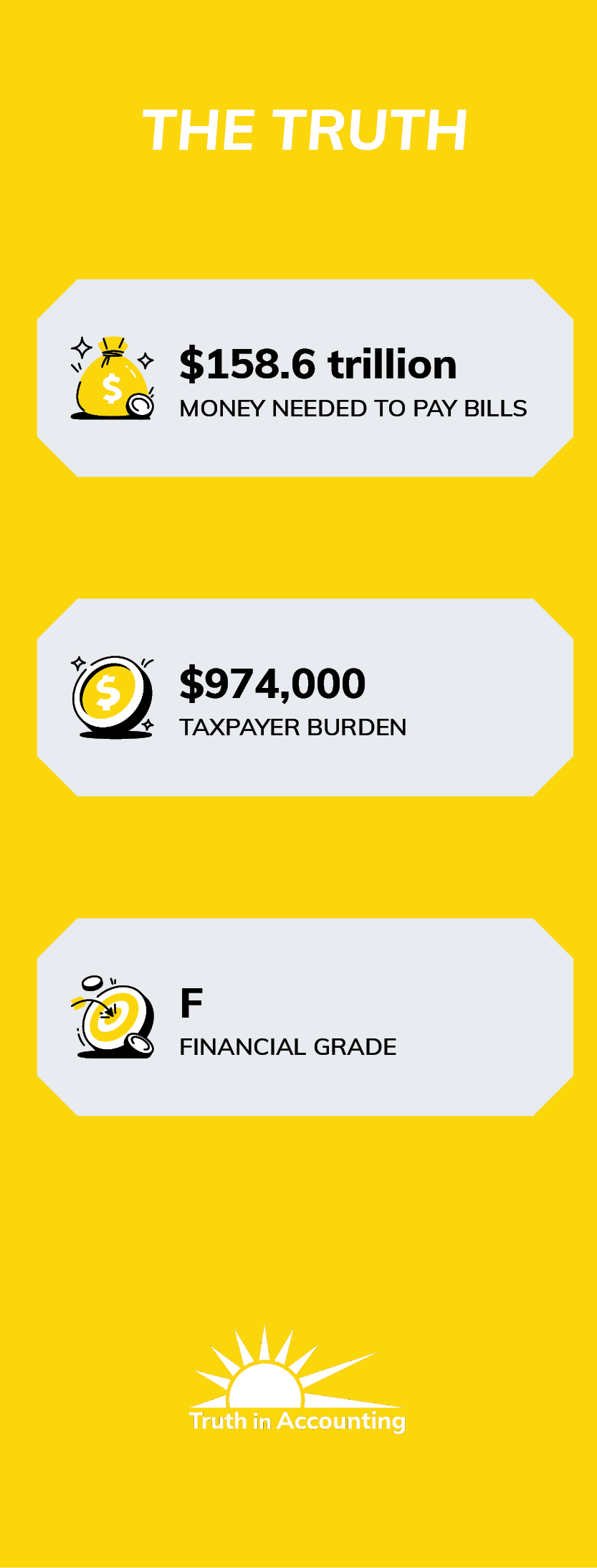

2025 Financial State of the Union (Released 4/15/2025) Use Create Your Own Federal Chart to see additional federal financial and economic data, and rhetorical analysis

Prior Years' TIA Data2024 Financial State of the Union 2023 Financial State of the Union 2022 Financial State of the Union 2021 Financial State of the Union Other ResourcesFinancial Report of the U.S. Government Publishing Entity: U.S. Department of Treasury |