Pension Methodology

Plan Assets: Resources of a pension plan that are available to pay for the benefits promised to its retirees and their beneficiaries.

Promised Benefits: Liabilities in the form of deferred compensation owed to the employees whom the plan covers.

Unfunded Benefits: The amount of promised benefits remaining after subtracting the plan assets. If the plan assets exceed the promised benefits, then the benefits are overfunded.

% Funded: The amount of plan assets divided by the promised benefits, expressed as a percentage. This serves as a measure of how much money has been set aside to fund the pension plan.

Discount Rate: The interest rate used to calculate the present value of the plan’s unfunded benefits. The higher the discount rate, the lower the value of the liability.

% Contributed: The percentage of the actuarially determined contribution (ADC) that the employer actually contributed. The ADC is the target or recommended contribution to a pension plan during the reporting period, determined in conformity with Actuarial Standards of Practice.

State Share: The percentage of the unfunded benefits of a pension plan that the State is liable for funding.

Other post-employment benefits (OPEB) Methodology

Plan Assets: Resources of an OPEB plan that are available to pay for the benefits promised to its retirees and their beneficiaries.

Promised Benefits: Liabilities primarily in the form of retiree health care, life insurance, disability, and other benefits owed to the employees whom the plan covers.

Unfunded Benefits: The amount of promised benefits remaining after subtracting the plan assets. If the plan assets exceed the promised benefits, then the benefits are overfunded.

% Funded: The amount of plan assets divided by the promised benefits, expressed as a percentage. This serves as a measure of how much money has been set aside to fund the OPEB plan.

Discount Rate: The interest rate used to calculate the present value of the plan’s unfunded benefits. The higher the discount rate, the lower the value of the liability.

% Contributed: The percentage of the actuarially determined contribution (ADC) that the employer actually contributed. The ADC is the target or recommended contribution to an OPEB plan during the reporting period, determined in conformity with Actuarial Standards of Practice.

State Share: The percentage of the unfunded benefits of an OPEB plan that the State is liable for funding.

------

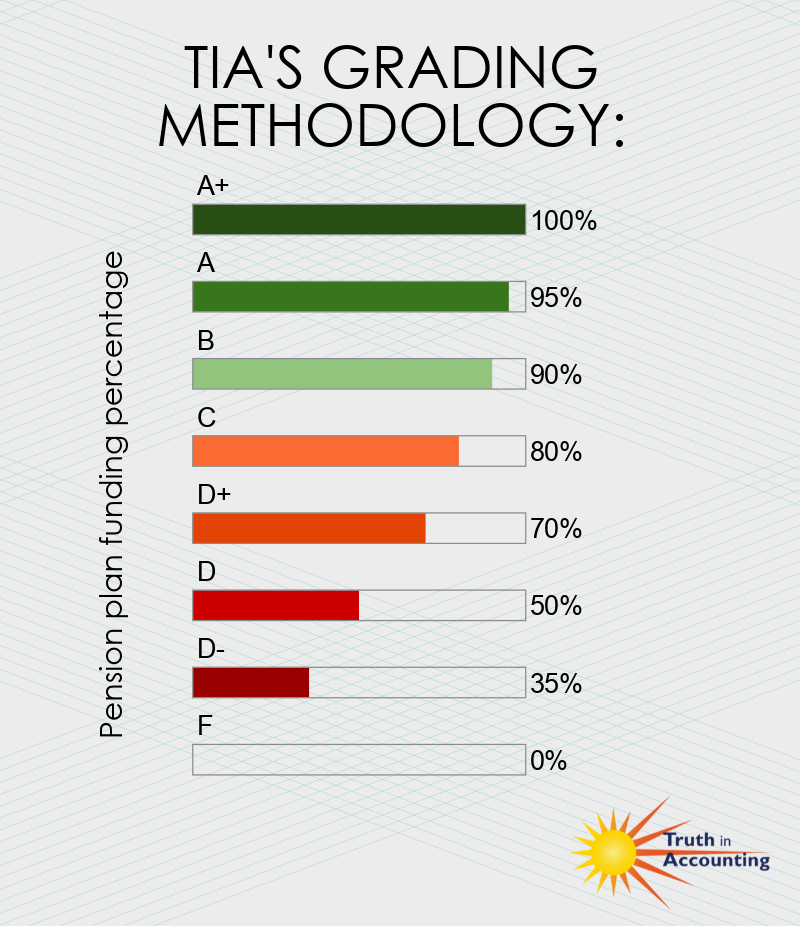

The grading scale is related to the funding status categories outline by the Employee Retirement Income Security Act (ERISA) of 1974. Under this law a plan becomes "endangered" when its asset-to-liability level falls below 80 percent, and it's "critical" when it drops below 65 percent.